Building a p2p lending & borrowing platfrom

When we need financial support we usually first reach out to peers to see if they can help before going to financial institutions like banks and microfinances. The reason people prefer lending from peers is because the lending process is faster and requires less paperwork. More importantly, in most cases it requires no collateral other than mutual 'trust'.

Despite the fact that 2020 was hit by the COVID19 pandemic, I was lucky to land a job straight from college. As a college graduate without a lot financial burden, it didn't take long for my peers to realize that I had some extra funds at my disposal for them to borrow. At my surprise most of these friends who came to borrow money from me were proposing to return the money with a small interest. Roughly from 3-15% for a month. Since they seemed happy doing so(I think that interest was meant for them to motivate me keep lending them the money) I went with the flow.

It wasn't too long for me to realise that I needed a proper tool beyond excel and notes on my phone to keep track of who owes me how much and due when. Thinking of a solution to solve this challenge, I decided to go beyond loan records keeping and dived deeper into peer to peer lending and borrowing. However, most of the research and products which I came across were about 'smart aligorithms' to match lenders and borrowers who may not be connected in anyway other data attributes which are computed by an AI model. Instead of heavily relying on financial data like credit history, which is sadly not so easily available for the market I was targeting, to match lenders and borrowers I decided to leverage social network from user's contacts list--just like back in the old days when people lended each other based on trust.

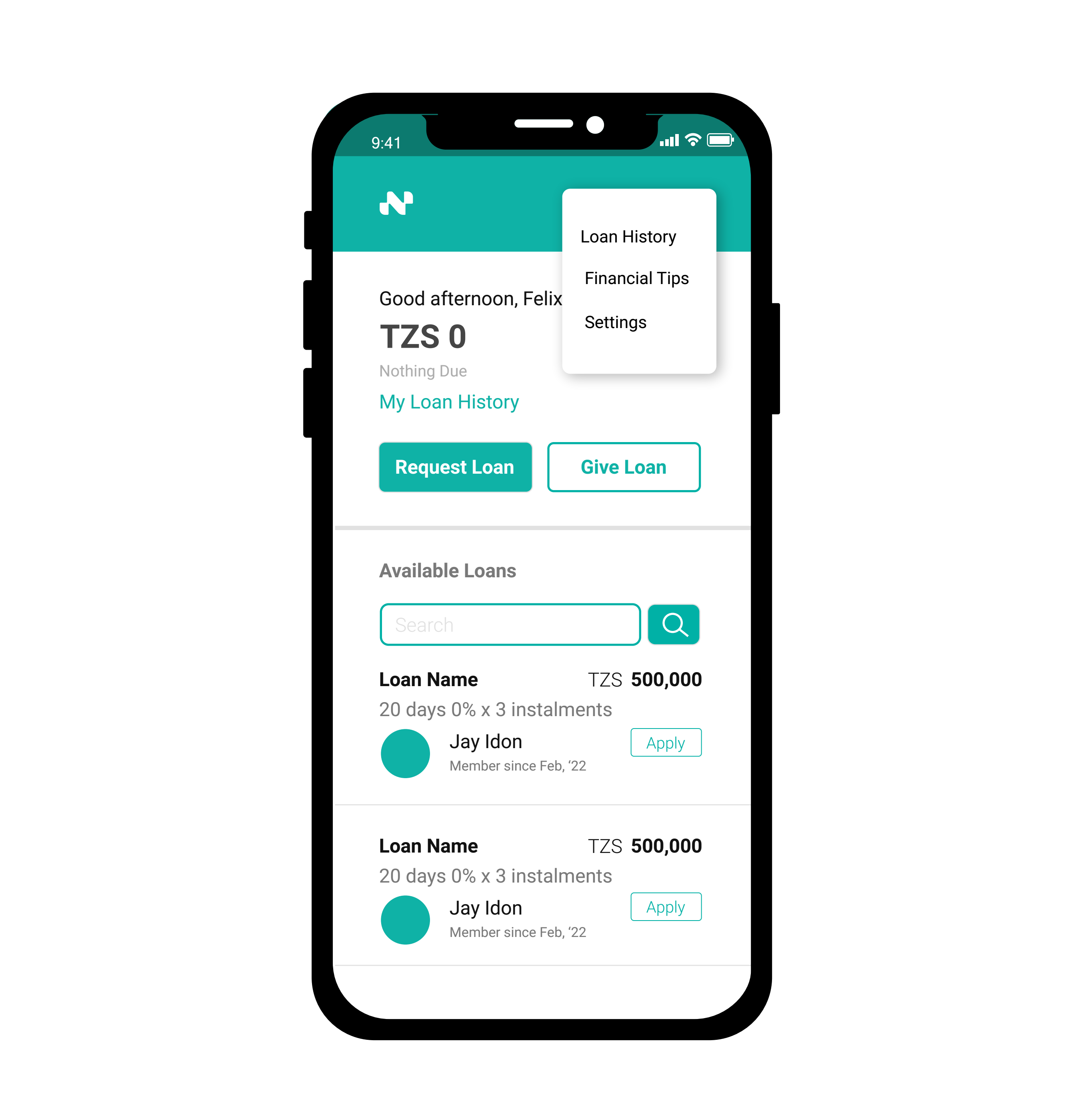

My initial MVP was to enable a person be able to know who from their contacts is giving a loan, for how long and under which terms. In addition, the app also enabled borrowers to send loan requests to the lender and specify how the money should be disbursed to them. Once the loan request is approved and the money is disbursed, a transaction with a pending status is created and shared with the borrower. This MVP was shared and tried with my friends who also found it useful to keep track who they or owes them money.

After testing the MVP with a wider audience I learned the main problem with p2p lending is actually not knowing who can give you a loan when you need it or keeping records of who owes you how much but rather debt colellection. 40% of 20 people I interviewed said that they would rather give a friend who is in need of cash a small amount of money and expect nothing in return rather than lending them a considerably large amount of money because they are afraid of following up or pressuring their friends to pay them back. To address the debt collection challenge, I thought automated SMS reminders could do the job. Working on the autmated SMS reminders I had to make sure that these messages:

- Are as less robotic as possible to the extent that the borrower can't know they are been sent/generated automatically.

- Are unique everytime they are sent.

- Have a context and has a tone which changes depending on the age of the loan. For example, a reminder to pay a loan which is not overdue has a more polite tone than the one for a loan which is overdue.

This task was accomplished by creating a Machine Learning Generative Adversarial Network (GAN) model using sample messages. This ML model empowers the debt collection model to generate human-like message which are sent daily to borrowers to remind them to pay their debts if they haven't done so. Using this debt collection approach I have noticed borrowers have started paying earlier and are less likely to default...anyway who likes been sent debt reminder messages everyday by God knows what a bot!

To conclude, the niwezesheapp is now at the stage where I couldn't have imagined before I started building it. The problem which I was trying to solve initially became clearer everyday as I wrote more lines of code and constantly get feedbacks from real users. As of publishing this article niwezeshe has 1500+ users and have loan requests valued TZS 150M+. So, I would say, if you have an idea regardless how unclear it is get a piece of paper and jot it down and if you have time, start working on it.

Next time I will also write how implementing a reward system where borrowers get cash back when they pay before due date have boosted the rate of loan repayments.